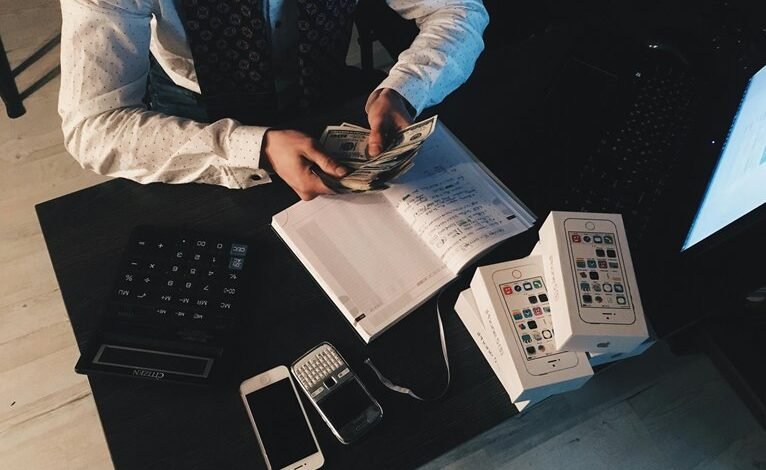

Financial Growth With Bookkeeping 8664005183

Accurate bookkeeping is a critical element in driving financial growth. It lays the groundwork for strategic decision-making and effective resource allocation. By meticulously tracking budgets and expenses, businesses can uncover potential savings and enhance their financial health. Moreover, the integration of technology into bookkeeping practices offers real-time insights, streamlining operations. This analytical approach not only mitigates risks but also positions businesses to adapt to changing market conditions. Exploring these facets reveals deeper implications for long-term sustainability.

The Importance of Accurate Bookkeeping

Accurate bookkeeping serves as the foundation of a healthy financial ecosystem for any business.

It ensures financial accuracy, allowing for informed decision-making and strategic planning.

Bookkeeping errors can lead to significant financial discrepancies, undermining trust and growth potential.

Key Bookkeeping Practices for Financial Success

Building on the foundation of accurate bookkeeping, several key practices can significantly enhance financial success for businesses.

Effective budget tracking allows for real-time financial insights, enabling informed decision-making. Additionally, thorough expense categorization helps identify cost-saving opportunities and ensures resources are allocated efficiently.

Leveraging Technology for Efficient Financial Management

As businesses seek to enhance their financial management, leveraging technology emerges as a critical strategy to streamline operations and improve accuracy.

Cloud-based solutions provide real-time access to financial data, facilitating collaboration and transparency.

Additionally, automated invoicing minimizes human error and accelerates cash flow, allowing organizations to focus on strategic growth initiatives.

This technological integration empowers financial freedom and operational efficiency.

Making Informed Decisions Through Financial Insights

Utilizing technology not only enhances operational efficiency but also equips businesses with valuable financial insights necessary for informed decision-making.

By implementing robust financial forecasting and thorough budget analysis, organizations can identify trends and allocate resources effectively.

This strategic approach empowers decision-makers, allowing them to navigate uncertainties with confidence, ultimately fostering a culture of financial freedom and sustainable growth within their enterprises.

Conclusion

In the realm of financial management, accurate bookkeeping stands as both a shield against uncertainty and a catalyst for growth. While negligence can lead to chaos and missed opportunities, diligent practices foster clarity and strategic foresight. By juxtaposing the pitfalls of disorganization with the advantages of systematic tracking, businesses can better appreciate the value of precise financial oversight. Ultimately, embracing disciplined bookkeeping not only safeguards assets but also paves the way for sustained financial prosperity and informed decision-making.